Buy Insurance Car landscape inside the USA, it’s critical to recognize your options and the importance of having adequate coverage. Buy Insurance Car is not just a prison requirement in maximum states; it additionally affords essential monetary safety within the occasion of injuries, robbery, or different unforeseen incidents.

Visit for More info about Autowheeltech.

Understanding Buy Insurance Car in the USA

Why You Need Buy Insurance Car

Owning a car comes with obligations, and one of the maximum critical is making sure you have the proper insurance coverage. Car coverage protects you financially if you’re concerned about a coincidence that causes damage to every other individual or their belongings. It can also cover your automobile towards damages from collisions or non-driving incidents like robbery or herbal failures.

Types of Coverage

When shopping for vehicle insurance, it is critical to take into account various forms of insurance:

Liability Insurance: This is regularly required using law and covers damages you cause to others in a coincidence.

Collision Coverage: This will pay for maintenance in your car after a collision, regardless of fault.

Comprehensive Coverage: This protects against non-collision-related incidents, together with theft or climate harm.

Uninsured/Underinsured Motorist Protection: This coverage enables you in case you’re in a coincidence with a motive force who lacks sufficient coverage.

Personal Injury Protection (PIP): This covers medical costs for you and your passengers, regardless of who is at fault.

Customizing Your Policy

Every driving force has specific desires primarily based on factors together with driving history, area, and automobile kind. Most coverage providers permit you to tailor your coverage with non-obligatory coverages like roadside help, rental reimbursement, and mechanical breakdown coverage.

How to Get a Quote

Obtaining a vehicle coverage quote is commonly straightforward. You can start by way of supplying basic information approximately yourself and your car, inclusive of:

Your call and address

Vehicle make, version, and yr

Driving records

Many corporations provide online equipment that will let you evaluate costs from one-of-a-kind insurers quickly. It’s beneficial to study several options to find the nice coverage at the most competitive charge.

Discounts and Savings

Insurance groups regularly offer various reductions that may significantly decrease your top rate. Common discounts encompass:

Safe driving force reductions for preserving an easy report

Multi-policy reductions for bundling automobiles with home or other insurance

Discounts for motors geared up with safety functions.

Car coverage is an important factor of responsible vehicle ownership. It protects you financially in the occasion of an accident, theft, or damage in your vehicle. With such a lot of forms of insurance available, finding the right policy can appear overwhelming. This whole guide will spoil the entirety you need to understand approximately vehicle coverage, helping you make an informed selection.

What is Buy Insurance Car?

Buy Insurance Car is an agreement among you and an insurance business enterprise that offers economic insurance in the occasion of accidents or damages. When you buy coverage in your vehicle, you are buying safety that covers numerous potential scenarios, inclusive of vehicle upkeep, medical prices, and legal liabilities.

The primary goal of Buy Insurance Car is to mitigate the risks and financial burdens that arise from owning a car. It’s mandatory in most international locations, to make sure that drivers are financially answerable for damages or accidents they cause.

Why Do You Need to Buy Insurance for Your Car?

1. Legal Requirement

In most areas, Buy Insurance Car is a felony requirement. Driving without it may bring about hefty fines, license suspension, or even jail time.

2. Financial Protection

Accidents can be steeply priced. Car maintenance, clinical bills, and ability complaints can fast upload up. With vehicle insurance, you’re covered by those financial burdens.

3. Peace of Mind

Accidents are unpredictable, and having insurance provides peace of mind understanding you’re blanketed if something is going incorrect. Whether it’s a minor fender-bender or a primary collision, coverage ensures you are no longer financially ruined.

Types of Buy Insurance Car Coverage

When you buy Buy Insurance Car, there are distinctive varieties of coverage you could pick from. Each provides varying levels of safety depending on your needs and budget.

1. Liability Coverage

Liability coverage is required in maximum places. It covers the cost of damages and accidents you cause to others in an accident. This consists of:

Bodily Injury Liability: Pays for scientific fees of others injured in an accident where you’re at fault.

Property Damage Liability: Covers repairs or substitutes of some other person’s automobile or assets.

2. Collision Coverage

Collision insurance pays for maintenance or substitute of your vehicle if it’s broken in a coincidence, regardless of who’s at fault. This is particularly vital for more recent vehicles, as upkeep may be steeply priced.

3. Comprehensive Coverage

Comprehensive insurance protects your vehicle from non-collision incidents such as robbery, vandalism, or natural screw ups. If a tree falls for your car or it is stolen, comprehensive insurance will cover the restoration or replacement expenses.

4. Personal Injury Protection (PIP)

Personal Injury Protection, also called PIP, covers clinical expenses for you and your passengers regardless of fault. It also can cover lost wages and other related charges attributable to the accident.

5. Uninsured/Underinsured Motorist Coverage

This insurance protects you if you’re involved in an accident with a driver who has no coverage or insufficient insurance. It can cover clinical bills and vehicle restoration costs while the other party is not able to pay.

How to Choose the Right Buy Insurance Car Policy

1. Evaluate Your Needs

Before you purchase insurance for your car, consider your unique desires. Consider elements consisting of your vehicle’s age, your riding habits, and your economic state of affairs. For instance, when you have a brand new or high-priced vehicle, full coverage (which includes collision and comprehensive coverage) can be a higher preference.

2. Compare Insurance Companies

Different insurers offer exceptional fees and coverage alternatives. It’s vital to save around and compare prices from diverse carriers. Look for companies with top client evaluations, robust financial rankings, and aggressive costs.

3. Consider Your Budget

While comprehensive coverage provides extra protection, it’s additionally greater costly. Make sure your automobile insurance suits your price range. Some insurers provide discounts if you package your automobile coverage with other sorts of coverage like home insurance.

4. Understand Policy Details

Carefully study the phrases and situations of your coverage policy. Understand what’s protected and what’s no longer. Pay near attention to exclusions, deductibles, and insurance limits. If you are unsure, ask your coverage agent for clarification.

United States

| Type of Insurance | Description | Mandatory/Optional |

|---|---|---|

| Liability Coverage | Covers damages to others for which you are legally responsible (injuries and property damage). | Mandatory in most states |

| Bodily Injury Liability | Pays for medical expenses and lost wages for injuries to others in an accident you caused. | Mandatory in most states |

| Property Damage Liability | Covers costs to repair or replace damaged property (e.g., vehicles, fences) caused by your accident. | Mandatory in most states |

| Collision Coverage | Covers damage to your own vehicle resulting from a collision with another vehicle or object. | Optional |

| Comprehensive Coverage | Covers non-collision-related damages (e.g., theft, vandalism, natural disasters). | Optional |

| Uninsured Motorist Coverage (UM) | Protects you if you’re hit by a driver without insurance. | Required in some states, optional in others |

| Underinsured Motorist Coverage (UIM) | Covers costs if the at-fault driver’s insurance is insufficient to cover damages. | Required in some states, optional in others |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers regardless of fault. | Required in some states, optional in others |

| Medical Payments Coverage (MedPay) | Helps pay medical expenses for you and your passengers after an accident, regardless of fault. | Optional |

| Gap Insurance | Covers the difference between what you owe on your car loan and its current market value if totaled. | Optional |

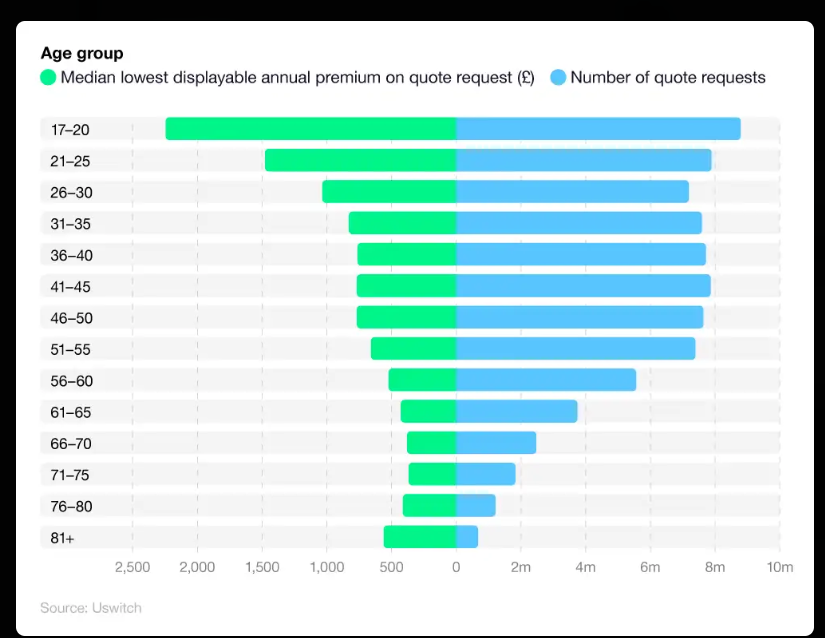

Average Car Insurance Premiums

| Coverage Type | Average Annual Premium (USD) |

|---|---|

| Liability Coverage | $600 – $1,200 |

| Collision Coverage | $300 – $700 |

| Comprehensive Coverage | $200 – $500 |

| Uninsured Motorist Coverage | $150 – $300 |

| Personal Injury Protection (PIP) | $300 – $600 |

Common Mistakes to Avoid When Buying Buy Insurance Car

1. Not Shopping Around

One of the largest mistakes human beings make once they buy insurance for their automobile isn’t comparing a couple of rates. Prices and insurance can vary substantially among carriers, so it’s usually an amazing idea to get a minimum of three fees earlier than making a decision.

2. Choosing the Minimum Coverage

While opting for minimal liability coverage can also prevent money on charges, it can mean you are underinsured. In the occasion of a severe accident, minimal insurance won’t be enough to cover all costs, leaving you financially inclined.

Three. Overlooking Discounts

Many coverage groups provide reductions that can decrease your premium. Some commonplace discounts include safe motive force discounts, multi-coverage discounts, and reductions for putting in anti-theft gadgets.

4. Failing to Update Your Policy

If you circulate to a brand new area or considerably trade your riding habits, it’s critical to update your automobile insurance coverage. Factors like your ZIP code and annual mileage can affect your top class.

Conclusion

In summary, securing car coverage is crucial for all drivers inside the USA. By understanding the varieties of coverage to be had, customizing your coverage to fit you, and taking advantage of discounts, you can make certain that you are thoroughly covered even as also handling costs successfully. Always compare costs from a couple of carriers to locate the exceptional deal tailored to your precise state of affairs.

FAQs

1. What happens if I power without Buy Insurance Car?

Driving without coverage can bring about legal penalties, such as fines, license suspension, and vehicle impoundment. If you are involved in an accident without coverage, you can be in my opinion accountable for all damages and scientific fees.

2. Can I switch vehicle insurance corporations?

Yes, you may switch car coverage agencies at any time. Just make sure to have your new policy in the region earlier than canceling the vintage one to keep away from a lapse in insurance.

3. How can I decrease my automobile insurance top rate?

There are several approaches to lowering your premium, together with growing your deductible, retaining an easy riding document, and taking gain of discounts supplied with the aid of your insurer.

4. Does my Buy Insurance Car cover rental motors?

It depends on your policy. Some insurance regulations amplify condominium motors, even as others may require you to purchase additional insurance. Check with your insurer to see what’s protected.

5. What is the difference between full coverage and liability coverage?

Liability coverage covers damages and accidents you cause to others, whilst full coverage consists of additional protection, which includes collision and complete insurance, which can pay for damages to your car.